Focus

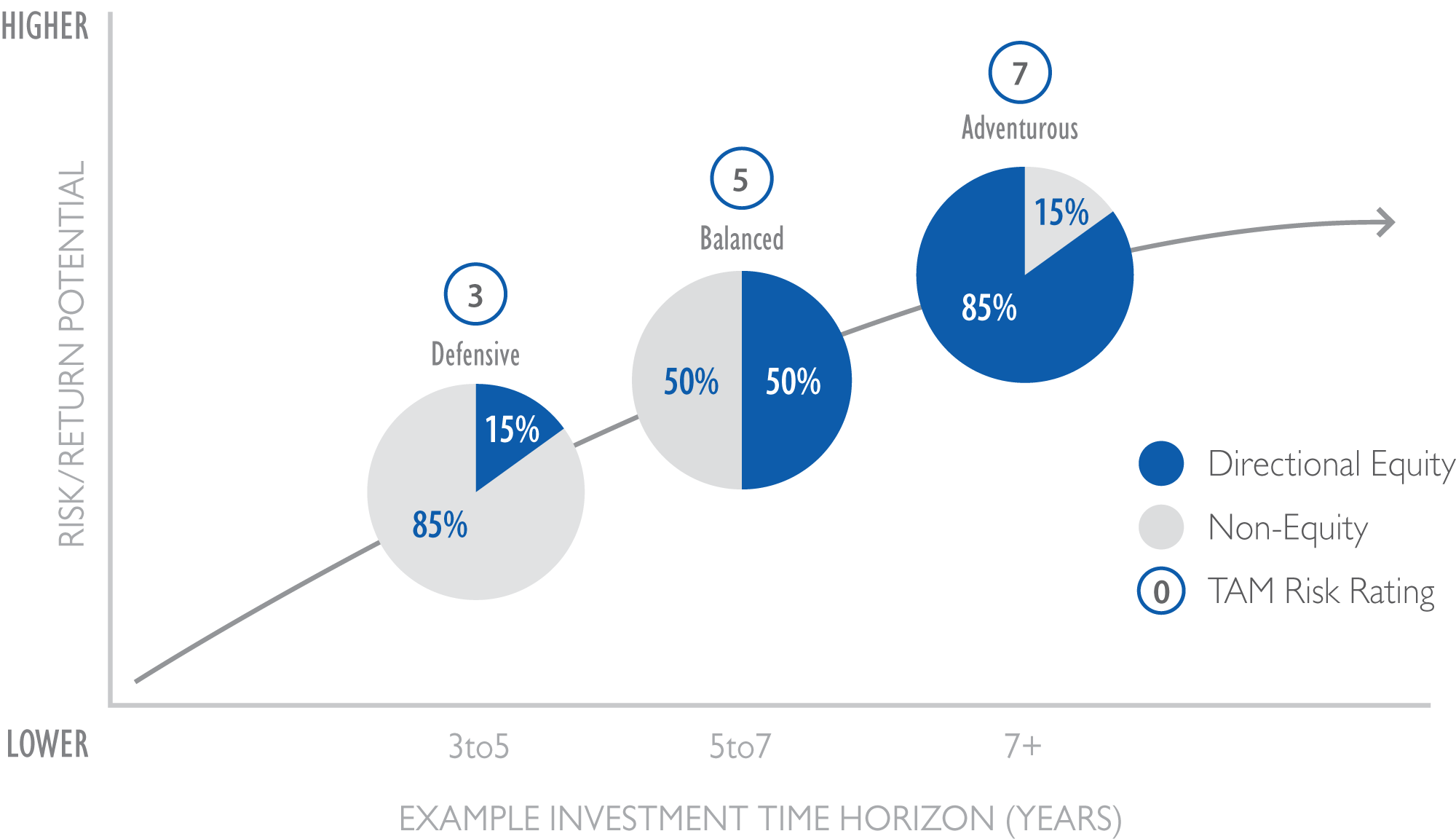

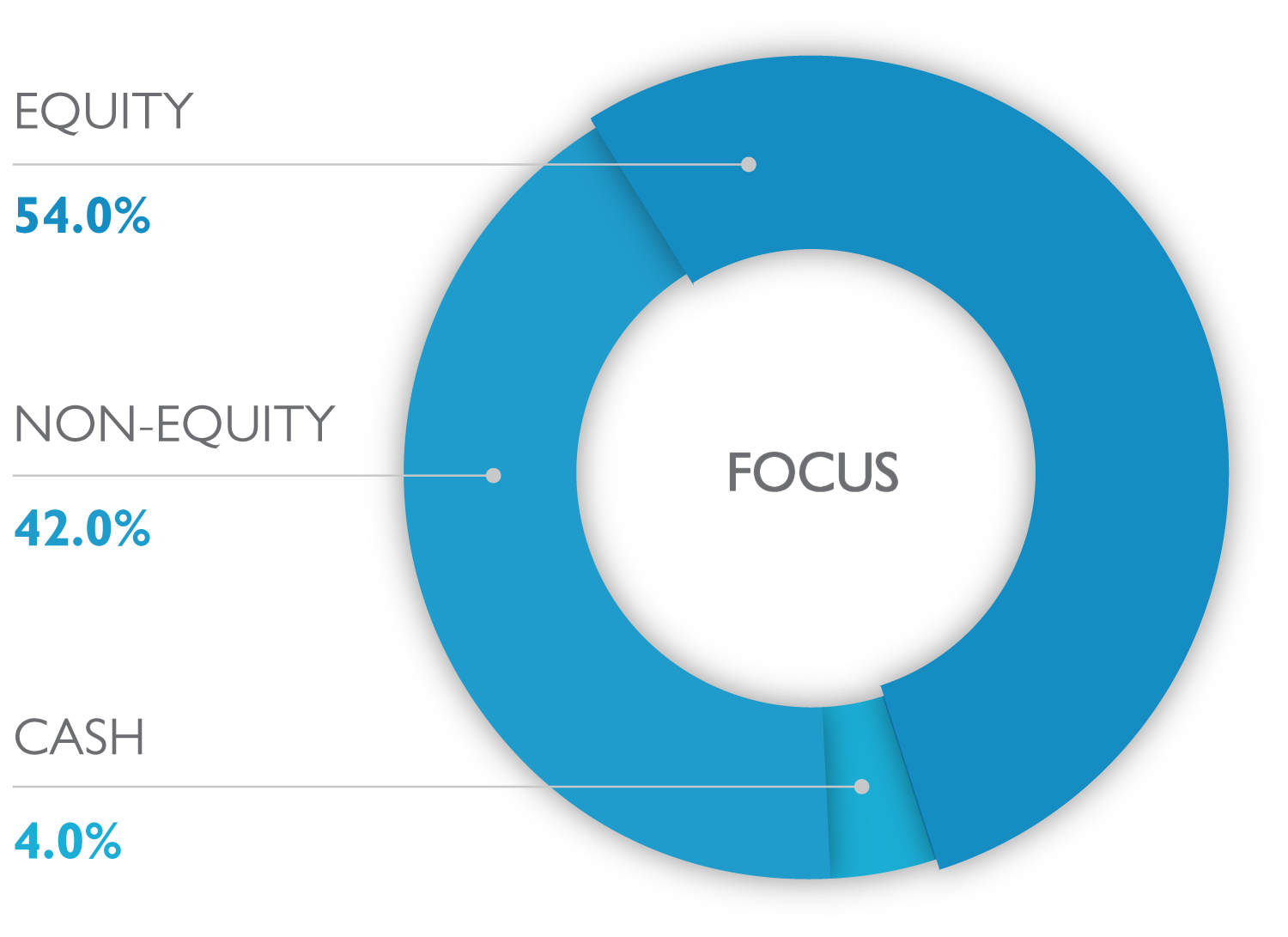

The Focus portfolios are the default priced Focus offering. This default product portfolio comprises risk graded investment portfolios invested in unit trusts, mutual funds, OEIC's, regulated investment funds and exchange traded funds (ETFs). TAM Asset Management seek managers whose aim is to outperform their respective markets. Asset classes you may find in this portfolio are Government and Corporate Debt, Equities, Absolute return, property, commodities as well as cash. classification. Three Focus risk graded portfolios are offered, Defensive (low risk to equities), Balanced (medium risk to equities) and Adventurous (Higher risk to equities). Factsheets for these default priced products are available below for review.

FOCUS portfolios at TAM seek the "best of the best" approach of collective investment funds allowing for significant diversification at default pricing.

The Focus portfolios are the default priced Focus offering. This default product portfolio comprises risk graded investment portfolios invested in unit trusts, mutual funds, OEIC's, regulated investment funds and exchange traded funds (ETFs). TAM Asset Management seek managers whose aim is to outperform their respective markets. Asset classes you may find in this portfolio are Government and Corporate Debt, Equities, Absolute return, property, commodities as well as cash. classification. Three Focus risk graded portfolios are offered, Defensive (low risk to equities), Balanced (medium risk to equities) and Adventurous (Higher risk to equities). Factsheets for these default priced products are available below for review.

FOCUS portfolios at TAM seek the "best of the best" approach of collective investment funds allowing for significant diversification at default pricing.

Click here for Focus Fund Factsheet

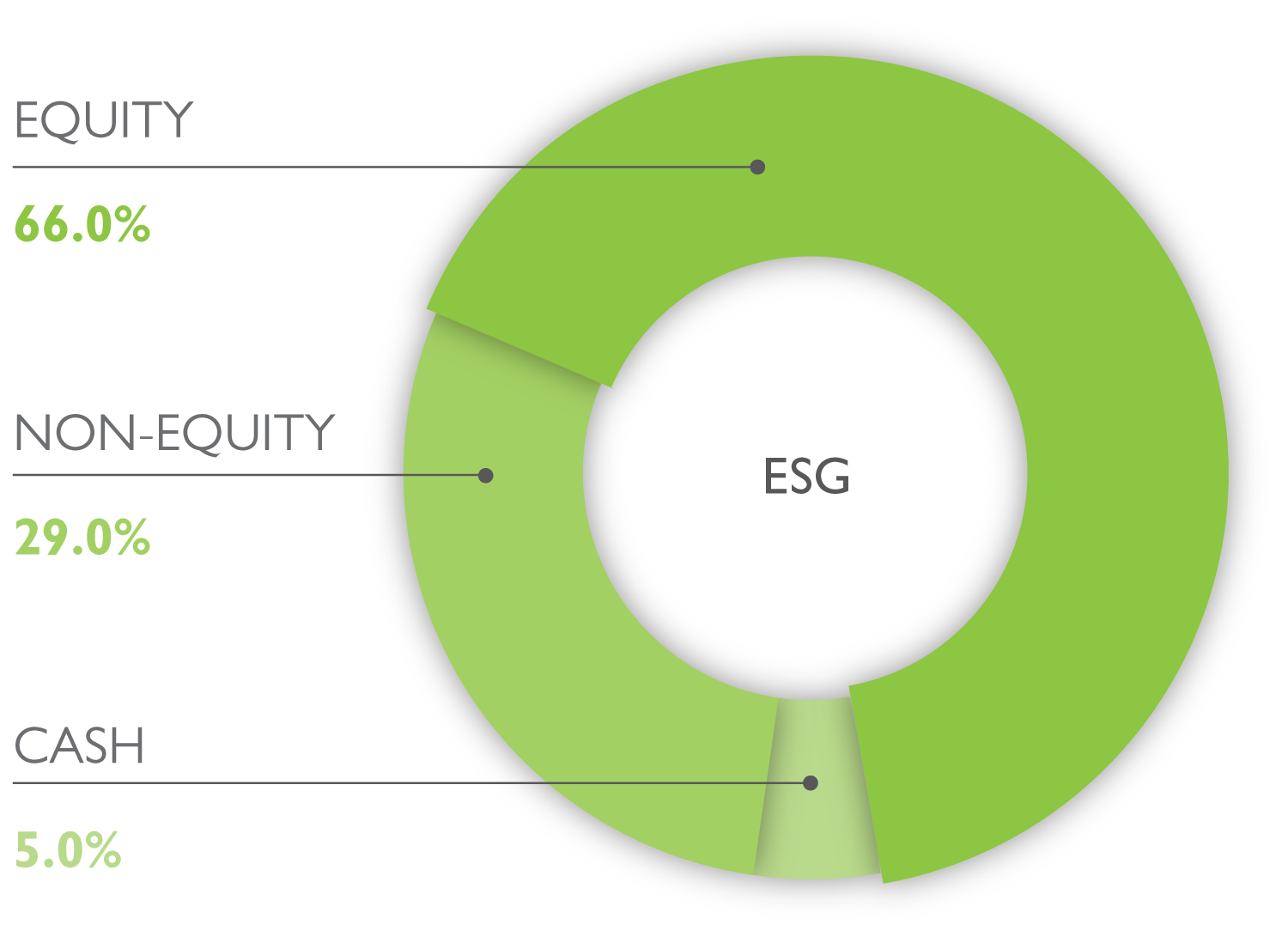

ESG

This is not a default fund but offers exposure to an optional ESG (environmental, social and governance)

Growth portfolio comprising of socially responsible investment vehicles including unit trusts, OEIC's, mutual funds and exchange traded funds (ETFs),

whose managers aim to outperform their respective markets. Asset classes you may find in this portfolio are Government and Corporate Debt,

Equities, Absolute return, property, commodities as well as cash. classification.

ESG Growth seeks to generate capital growth over the medium to longer term, with the aim of riding out short-term fluctuations in value.

The portfolio has a growth approach to equity exposure, typically comprising of 60-75% equity and 25-40% non-equity.

These weightings may deviate within set parameters, allowing managers to react to market conditions.

This is not a default fund but offers exposure to an optional ESG (environmental, social and governance)

Growth portfolio comprising of socially responsible investment vehicles including unit trusts, OEIC's, mutual funds and exchange traded funds (ETFs),

whose managers aim to outperform their respective markets. Asset classes you may find in this portfolio are Government and Corporate Debt,

Equities, Absolute return, property, commodities as well as cash. classification.

ESG Growth seeks to generate capital growth over the medium to longer term, with the aim of riding out short-term fluctuations in value.

The portfolio has a growth approach to equity exposure, typically comprising of 60-75% equity and 25-40% non-equity.

These weightings may deviate within set parameters, allowing managers to react to market conditions.

Click here for ESG Fund Factsheet

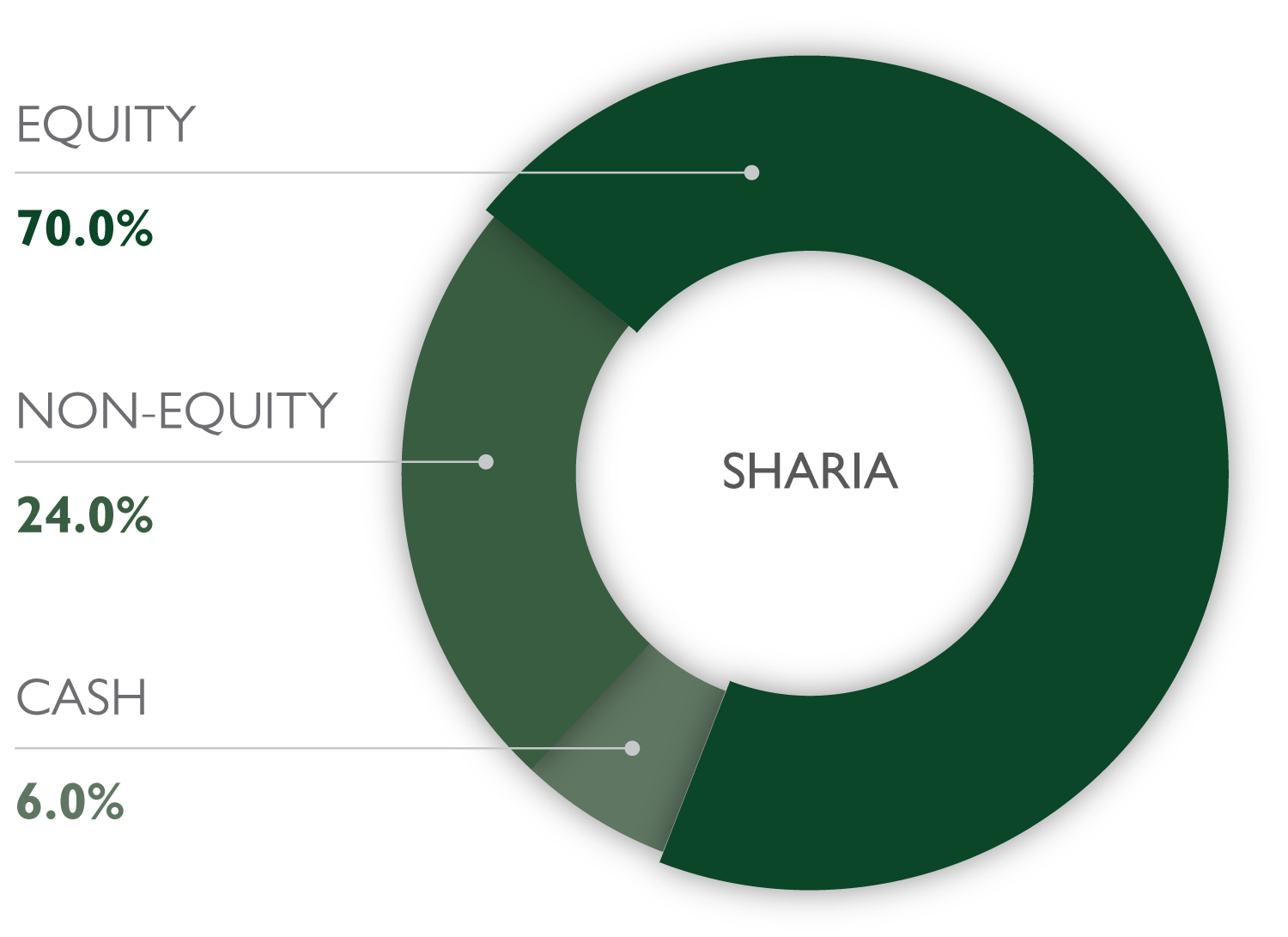

Sharia

This is not a default but offers exposure to an optional Sharia Growth portfolio comprising of Sharia-compliant investment vehicles including unit

trusts, OEIC's, mutual funds and exchange traded funds (ETFs), whose managers aim to outperform their respective markets.

Asset classes you may find in this portfolio are Sukuk Debt, Sharia compliant Equities, commodities as well as cash.

Sharia Growth seeks to generate capital growth over the medium to longer term, with the aim of riding out short-term fluctuations in value.

The portfolio has a growth approach to sharia equity exposure, typically comprising of 60-75% equity and 25-40% non-equity.

These weightings may deviate within set parameters, allowing managers to react to market conditions.

This is not a default but offers exposure to an optional Sharia Growth portfolio comprising of Sharia-compliant investment vehicles including unit

trusts, OEIC's, mutual funds and exchange traded funds (ETFs), whose managers aim to outperform their respective markets.

Asset classes you may find in this portfolio are Sukuk Debt, Sharia compliant Equities, commodities as well as cash.

Sharia Growth seeks to generate capital growth over the medium to longer term, with the aim of riding out short-term fluctuations in value.

The portfolio has a growth approach to sharia equity exposure, typically comprising of 60-75% equity and 25-40% non-equity.

These weightings may deviate within set parameters, allowing managers to react to market conditions.

Click here for Sharia Fund Factsheet